Resources

What’s The Difference Between a Conventional and FHA Loan?

Before falling in love with that dream kitchen, ask yourself: “How much house can I really afford?” This guide breaks down the 3 budgeting rules that matter, explains the 30% housing cost rule, and helps you avoid common money traps—all so you can buy smart and live free.

How Much House Can I Really Afford?

Before falling in love with that dream kitchen, ask yourself: “How much house can I really afford?” This guide breaks down the 3 budgeting rules that matter, explains the 30% housing cost rule, and helps you avoid common money traps—all so you can buy smart and live free.

Should You Buy a Home in 2025 or Wait?

Wondering if 2025 is the right year to buy a home or if you should wait? With mortgage rates stabilizing, inventory improving, and rents still climbing, timing your purchase matters more than ever.

Understanding Credit — How Trust, Choices, and Your Credit Score Shape Your Everyday Life

Credit plays a crucial role in personal finance, influencing everything from loan approvals to interest rates. This guide explains credit fundamentals, credit scores, and practical steps to build and maintain healthy credit.

Do You Need a 20% Down Payment?

Before falling in love with that dream kitchen, ask yourself: “How much house can I really afford?” This guide breaks down the 3 budgeting rules that matter, explains the 30% housing cost rule, and helps you avoid common money traps—all so you can buy smart and live free.

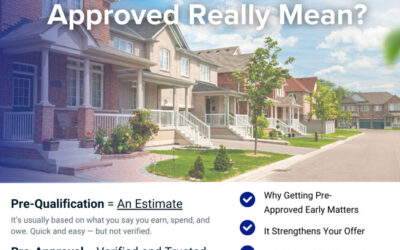

What is a Mortgage Pre-Approval?

Before falling in love with that dream kitchen, ask yourself: “How much house can I really afford?” This guide breaks down the 3 budgeting rules that matter, explains the 30% housing cost rule, and helps you avoid common money traps—all so you can buy smart and live free.

Understanding Your Home Loan Options: Broker, Bank, or Direct Lender?

Understanding Your Home Loan Options: Broker, Bank, or Direct Lender? When applying for a mortgage, homebuyers have multiple options for securing financing. The three primary consumer channels are mortgage brokers, banks, and direct lenders. Each option has distinct...

Credit Matters

Credit Matters How to Improve Your Credit Score Before Buying a Home When buying a home, your credit score plays a major role in determining your mortgage approval, interest rate, and overall loan costs. A higher credit score can save you thousands of dollars over the...

Financing Options

Understanding Mortgage Options: FHA, Conventional, VA, and More Buying a home is one of the most significant financial decisions ever, and choosing the right mortgage is crucial. With so many loan programs available, understanding their differences can help you find...

Important Homebuying Factors

Important Homebuying Factors Location, Location, Location – Is It the Most Important Factor When Buying a Home? When buying a home, you've likely heard the phrase, "location, location, location." Real estate experts often emphasize that location is the most critical...